Buying a single-family rental home could be a great investment

Purchasing a single-family rental home as an investment property that you rent out can be a smart move. The rental money you earn could cover the mortgage.

And it may deliver a tidy monthly income stream, to boot. That could help you pay off the mortgage on your primary residence, along with a myriad of other benefits.

From a form of retirement savings to an additional income stream, owning a single-family home rental could put you in a great spot financially.

Get started on your rental home loan application here. (Apr 28th, 2019)

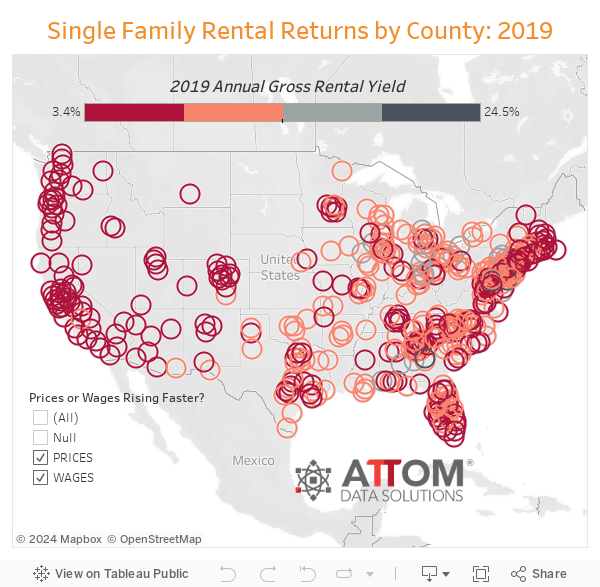

Report: Annual rental yield is up from last year

A new report spotlights the best counties for claiming a single-family rental home. It also shows that typical rental yields and profit margins are slightly up. And it reveals that rents are rising quicker than wages in most markets.

A new study by ATTOM Data Solutions analyzed single-family rental home returns in 432 counties. Among its findings, in 2019:

- The average annual gross rental yield (annualized gross rent income divided by median purchase price of single-family homes) was 8.8 percent. That’s up from last year’s average of 8.7 percent.

- Potential annual gross rental yields rose in 57 percent of the counties (248 of 432) vs. 2018.

- Rents climbed faster than wages in 55 percent of the counties (236 of the 432).

- Counties with the highest potential annual gross rental yields were:

- Baltimore City, Maryland (24.5%)

- Bibb County, Georgia (21.9%)

- Cumberland, New Jersey (21.2%)

- Winnebago, Illinois (17.1%)

- Wayne County, Michigan (17.1%).

- Counties with a population of at least 1 million that had the highest potential annual gross rental yields were:

- Wayne County (Detroit), Michigan (17.1%)

- Cuyahoga County (Cleveland), Ohio (12%)

- Allegheny County, Pennsylvania (10.9%)

- Cook County (Chicago), Illinois (9.7%)

- Philadelphia County, Pennsylvania (9.4%).

var divElement = document.getElementById(‘viz1554128099144’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’600px’;vizElement.style.height=’587px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

How to interpret the data

Todd Teta, chief product officer with ATTOM Data Solutions, says these findings mean good things to potential investors.

“What jumps out is this long-term trend of profits consistently higher in areas with relatively low rents and low wages,” he says. “You’d think wealthy areas would offer owners bigger returns. But it looks like lower home prices in those areas are too expensive. Prices and property taxes in other parts of the country, meanwhile, are low enough to help generate the biggest returns for landlords.”

Teta notes that profit margins in 2019 continue to follow a long-term pattern. This pattern shows that landlords are earning more profits in lower-cost areas in the South and Midwest. But they’re also earning less in higher-priced counties in the Northeast and West.

“In four out of 10 counties in the Midwest, profits this year commonly top 10 percent,” says Teta. “But not a single county in the West can boast that same return on the average three-bedroom home rental so far in 2019.”

The major takeaways

Teta adds that the most important finding is obvious.

“This report makes it pretty clear: Profits on single-family rentals are not quite where they were in the years right after the recession. But buying a home to rent it out is still a pretty good investment,” he says.

Bruce Ailion, Realtor and real estate attorney, echoes that sentiment.

“Single-family homes have historically delivered excellent monthly returns. And they’ve appreciated at or above the underlying inflation rate,” says Ailion. “For the average investor, a hard asset that provides income, tax, shelter and appreciation is hard to beat. After all, what can be better than having your tenant pay off your mortgage?”

There are several reasons why the aforementioned counties are safer bets for would-be landlords.

“A combination of money and preference might be driving this trend. That’s especially true among young families. Soaring home prices and high taxes in some regions may be cutting a lot of potential home buyers out of the market. Therefore, they have to rent,” notes Teta. “And the more renters out there, the more profits being offered to investors.”

There’s another factor at work here, too.

“Millennials and other young buyers have been moving away in recent years from the notion that home ownership must be part of the American dream. They’re gravitating more toward urban areas. And they don’t want the hassle, expense and responsibility of maintaining a house. That further expands the pool of renters,” Teta adds.

The pros and cons of purchasing a detached rental

Buying and owning a single-family rental home has its plusses and minuses.

“On the upside, our data show that the profit margins of renting one out are pretty good in most areas. That’s particularly true compared to what can be earned on more volatile investments, like the stock market. Single-family rents are also rising in a majority of counties across the country. So, the profits in most areas are healthy, consistent and rising,” says Teta.

But you need enough money to put down on a house and make any renovations necessary, he warns. “And you need to do the checking necessary to get good tenants.”

The downside? Being a landlord is a hard job. “You have to potentially deal with bad or non-paying tenants. Even with good background checks, you can end up with destructive or deadbeat renters,” Teta cautions.

Plus, you have to maintain and repair the property as needed. If you don’t have the skills or patience to do all of the above, you’ll need to hire a property manager to do this dirty work.

A questionnaire for would-be landlords

Want to know if you’re a good candidate to buy a single-family rental home? Teta suggests answering these questions first:

- Do you have enough money to purchase and, if necessary, renovate the home?

- Will you also have enough set aside for future repairs and other unexpected expenses?

- Will you have a financial cushion in case a tenant stops paying, moves out abruptly or damages the property?

- Are you prepared to manage the property yourself? Or can you afford to hire a separate property manager?

- Will your rental earnings cover the mortgage, upkeep, taxes and other expenses, and still generate a healthy profit?

Lastly, get plenty of help and guidance before jumping into the landlord pool.

“It’s important to work with a knowledgeable real estate agent until you have more landlord experience. There are many potential pitfalls a novice investor can encounter. Professional assistance will minimize the consequences of these missteps,” Ailion says.

Get started on your rental home financing here. (Apr 28th, 2019)

Mortgage Rates, Mortgage News and Strategy : The Mortgage Reports